Pandemics, financial crisis, protests against racism and violence, the climate emergency - 2020 can be characterized by a year of complete disruption, chaos and importantly - change. This year has shown us that nothing in this world is certain, with one exception - a changing world creates more regulatory change.

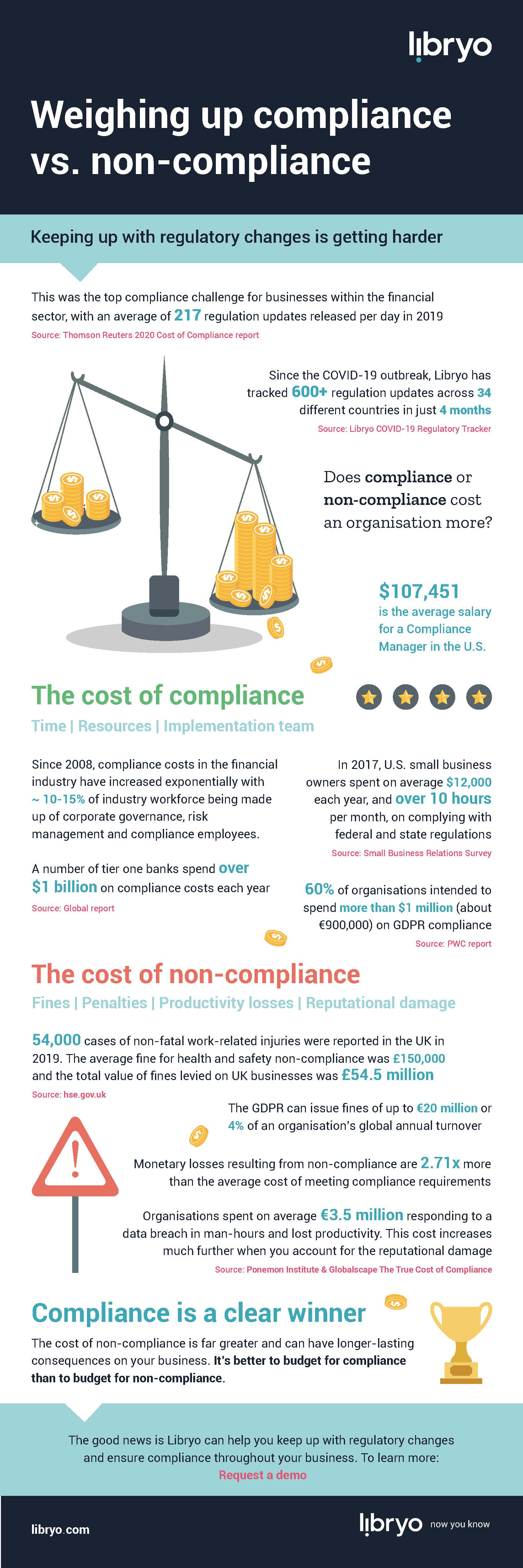

According to a 2020 Cost of Compliance report by Thomson Reuters, keeping up with regulatory change was found to be the top compliance challenge for businesses, within the financial sector, in 2020 with an average of 217 regulation updates released per day in 2019. With many other sectors being just as highly regulated or even more so than the financial sector, this number could be substantially higher for many other businesses to have to monitor around the world.

Since the beginning of COVID-19, we have seen a high volume of regulatory updates across many different industries, with Libryo sending out 600+ regulation updates across 34 different countries in just 4 months.

This consistent flow of regulatory change has left businesses with two choices:

- They calculate the cost of compliance to keep up and comply with these regulatory changes

OR - They fail to keep up and comply with regulatory changes, and suffer the costs of non-compliance

Luckily, with the help of legal technology, making sure your business is keeping up with regulatory changes and is compliant with legal requirements no longer has to be a costly and people-intensive solution that is only suitable for large corporations with big budgets. Here we take a look at what compliance costs typically consist of for a business vs. the potential costs of non-compliance. Let's take a deeper look into how technology has paved the way for a more automated and cost-effective approach to achieve compliance success for all businesses.

What is the cost of compliance?

Compliance costs usually include the time and resources needed to determine what your applicable regulatory requirements are so that you can comply with them, as well as an implementation team that can consist of an in-house compliance department or external consultants.

The cost of compliance differs greatly depending on the industry, and the size of your business, and unfortunately there’s no one size fits all when it comes to the perfect compliance solution. Legaltech solutions, however, can be used to automate and speed up the process, and have also been found to compare favourably with the overall costs associated with slower and people-intensive compliance solutions.

In the financial industry for example, a global report found that since the 2008 global financial crisis, the cost of compliance has increased exponentially with approximately 10-15% of the total financial industry workforce being made up of employees dedicated to corporate governance, risk management and compliance. This report also found that a number of tier one banks are spending an amount that exceeds $1 billion on compliance costs each year.

When it comes to small businesses, regulatory compliance is mostly managed by the business owner themselves. Regulatory burdens have been found to be a major hurdle for a small business owner, even acting as a deterrent for new entrepreneurs to start a business. According to a Small Business Relations Survey conducted in 2017, on average, small business owners in the U.S. are said to be spending $12,000 each year, and more than 10 hours per month, on complying with federal and state regulations.

This same survey also found that two of the main regulatory difficulties these small business owners face is that of “complexity of rules” and “difficulty interpreting and understanding rules”. These findings are a clear example of the need for reducing regulatory complexity and giving better access to plain language statutes.

Although compliance costs may vary per industry, and are clearly not insignificant, the cost of non-compliance is far greater, and usually has longer-lasting consequences on your business.

What is the cost of non-compliance?

Global estimates on the cost of compliance vs. non-compliance have shown that monetary losses resulting from non-compliance are 2.71 times greater than the average cost of meeting compliance requirements. These non-compliance costs are in the form of fines, penalties or settlement costs associated with breaking the law, and can also include expenses that come about as a result of business disruption or productivity losses.

Exposing businesses for regulatory breaches is also becoming increasingly common, resulting in many shortcomings being heavily publicised. Online platforms such as goodjobsfirst.org for example, exist to help expose large corporations that violate the law to deter future potential employees. With this, a company’s compliance and brand become intrinsically linked, and we start to recognise that a failure to comply with regulations come at a great opportunity cost to the brand name, reputation and potential loss of existing and new business, as well as attracting or retaining employees.

If you’re still not convinced, let the numbers speak for themselves. For the sake of comparing apples with apples, let’s take a tier one bank in the U.S. as an example. One rather large bank in particular, has received more than $3.5 billion in penalties and fines in 2020 alone and we are only 6 months in. Knowing that they’re in the financial sector, this far outweighs the monetary costs associated with the average annual spend on compliance for a bank - so in this case, the financial cost of non-compliance is far greater.

With the help of technology, knowing and keeping up with regulations doesn’t need to be the burden it once was. Find out how Libryo has helped many organisations across a number of different industries.

Libryo's tips to help your organisation meet its regulatory requirements

Hopefully by now it's clear that the potential costs (both direct and indirect) of non-compliance aren’t worth the risk. Here are some of our best tips to help ensure your organisation is meeting its regulatory requirements:

- Let technology do the legwork by automating the process of staying up to date with any regulatory changes that apply to your business. During this time, Libryo is offering businesses the opportunity to sign up for free access to receive COVID-19 related regulatory updates for a number of different jurisdictions. Sign up now or learn more about our free offering.

- Subscribe to plain language highlights of your applicable regulatory updates so that it is easier to know what the law requires of you. Libryo’s update notifications and legal sections include quick, easy to understand summaries of the legal text so that you’re always in the know and you don’t have to be a lawyer to know what it means.

- Opt for a Libryo Stream over a simple legal register to save time and resources while conducting legal research and make sure your business is complying with it’s regulatory requirements at all times.

- Understand your legal consequences of non-compliance with your business's regulatory requirements. Technology solutions like Libryo easily identify these for you with our customised Libryo Streams.

- It’s better to budget for compliance than to budget for non-compliance. Libryo offers a range of solutions to meet your business and budget needs. Learn more about our product offerings or get in touch to book a demo of the platform today!

Check out our infographic below: Weighing up compliance vs. non-compliance